Taxes can be added to your payment plans. Taxes can be location-based and controlled by country, state, or region. You can also add taxes to all payment plans, regardless of the customer's location.

Setting Up Your Taxes

Go to Settings > Taxes and complete the following steps:

-

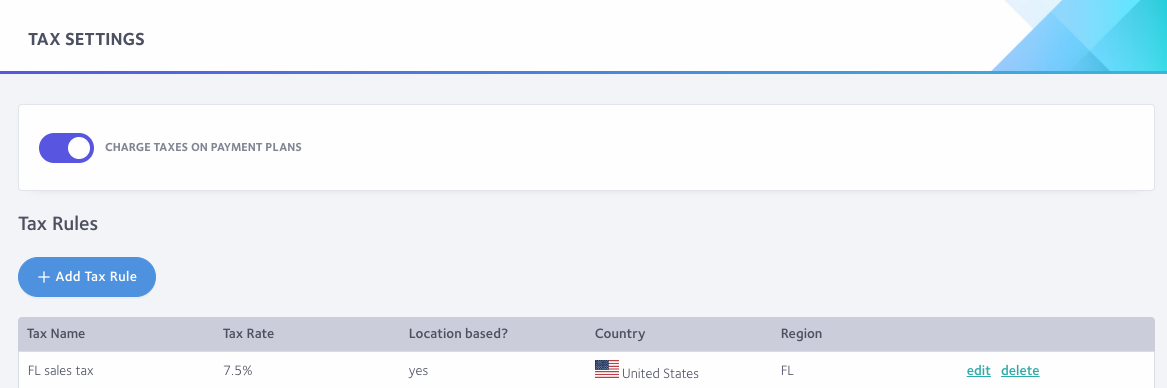

Select the 'Charge taxes on payment plans' option.

-

Select the 'add tax rule' button.

-

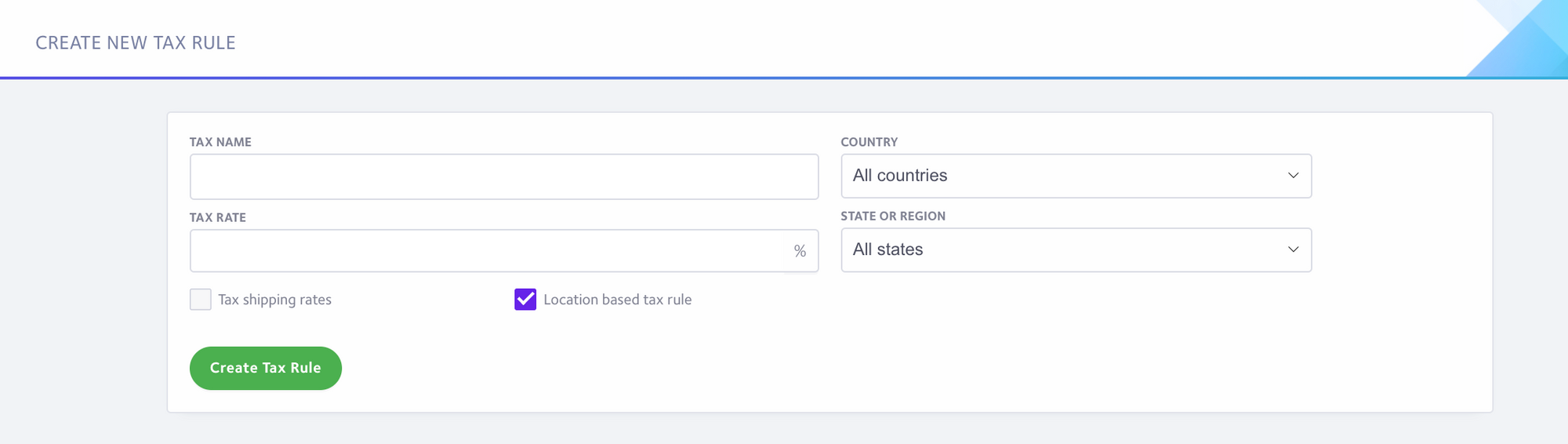

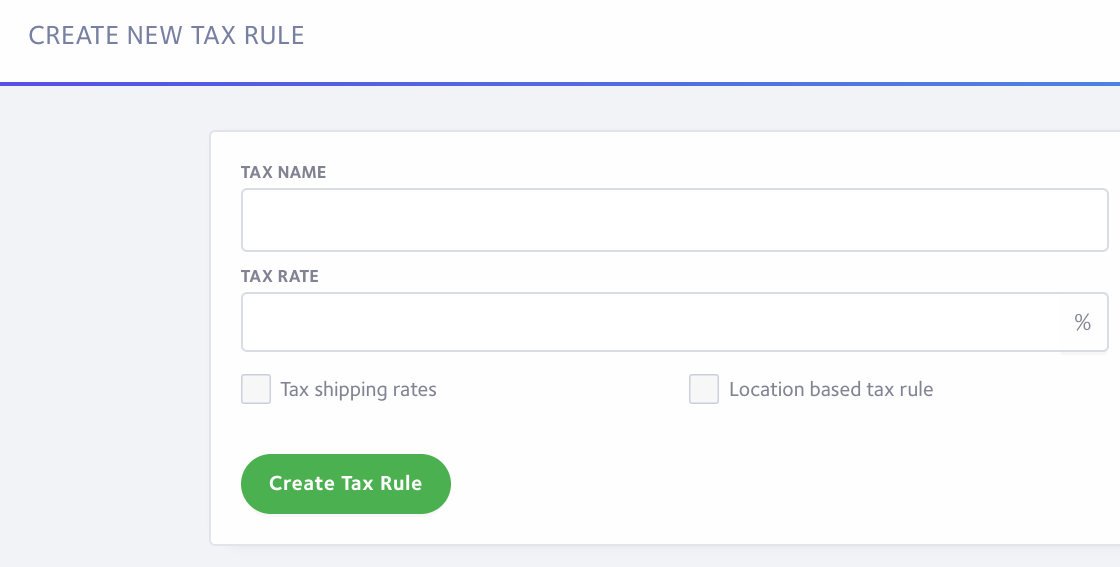

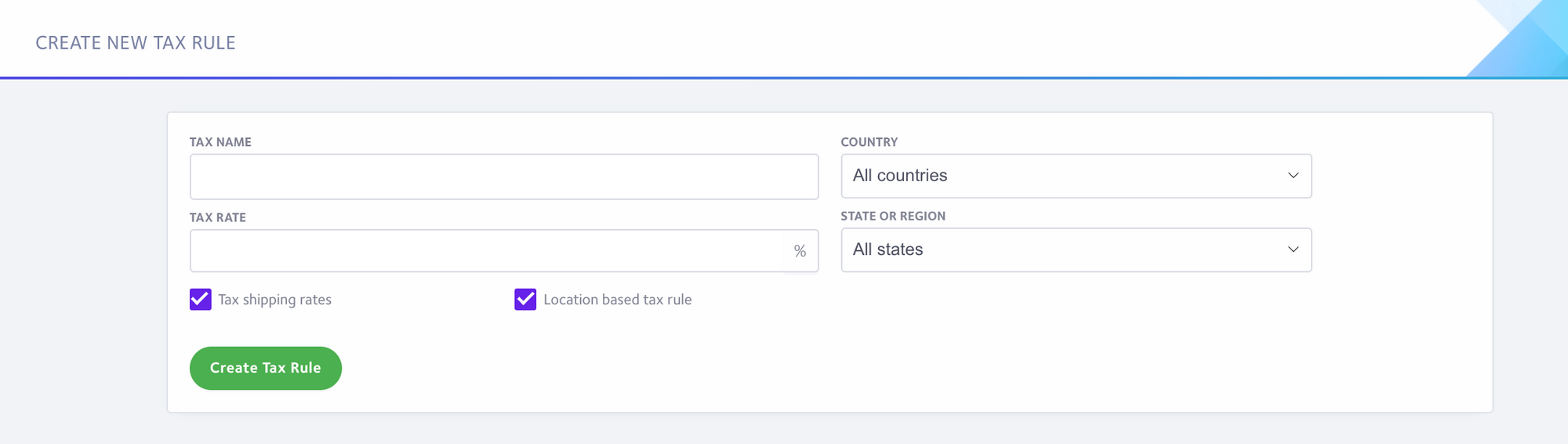

Create a new tax rule by entering:

A. Tax name (customers will see this in the payment plan summary)

B. Tax rate

C. For location-based taxes, select the 'location based tax rule' box and select your country, region, or state from the drop-down menus.

D.To set up a tax rule that will apply to all customers, regardless of location, leave the 'location based tax rule' box unselected.

E.You may also optionally include any shipping rate you charge in the tax calculation by checking the "tax shipping rates" checkbox

You add as many tax rules as you need by following the above steps.

If you require more complex tax rules, like city, local or municipal tax, we highly recommend using our integration with Avalara. You can learn more here: Avalara AvaTax Integration

Have more questions?

Please email us at support@partial.ly