Our integration with Avalara AvaTax lets you connect to the AvaTax API to calculate taxes on your payment plans during customer checkout. To learn more about Avalara, please click the following link: Avalara AvaTax

To get started, login to the Partial.ly merchant portal, click settings, and then integrations. At the bottom you will see an option for AvaTax.

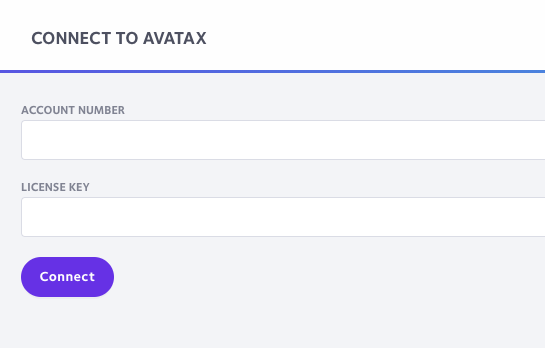

Click the Connect Avalara account link. On the following page, you'll need to enter your Avalara account number and license key.

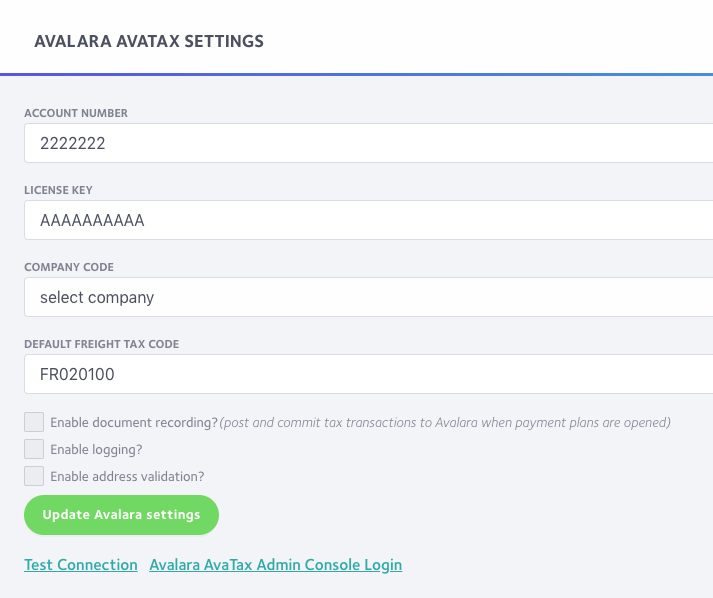

Settings

Once you have successfully connected your AvaTax account, you will see the AvaTax integration settings page, where you can configure several options.

- Company Code

- This is the company from AvaTax to use for tax calculations. Set this first.

- Default Freight Tax Code

- Send this value as the tax code for all shipping lines in your payment plan.

- Enable document recording?

- If this box is checked, Partial.ly will commit tax transactions to AvaTax when payment plans are opened. Partial.ly will also commit any refunds issued back to AvaTax.

- Enable logging?

- If this box is checked, Partial.ly will log all requests and responses sent to the AvaTax API. See the logging section below for more details.

- Enable address validation?

- If this box is checked, US and Canadian addresses will be validated with Avalara's address validation service during checkout.

If you need to change your account number or license key, you can use the Test Connection link to confirm Partial.ly is able to connect to AvaTax with the new credentials.

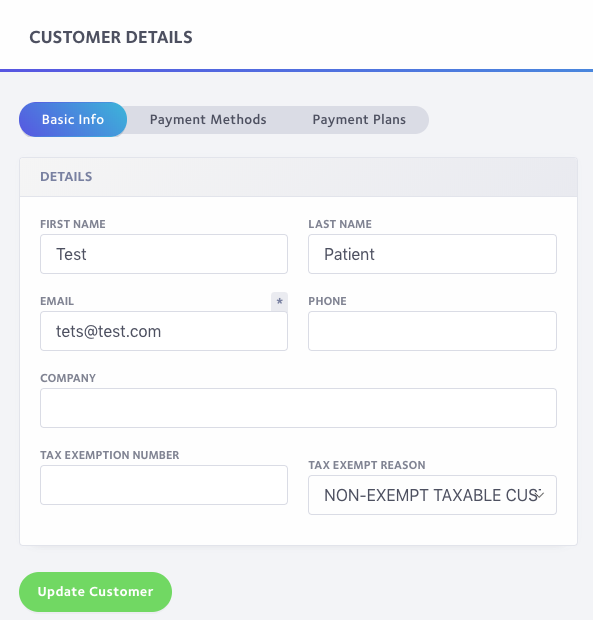

Customer tax exemption

You can set certain customers as tax exempt in the Partial.ly merchant portal. Set the Tax Exemption Number and Tax Exempt Reason on the customer details page shown below to exempt certain Partial.ly customers from taxes.

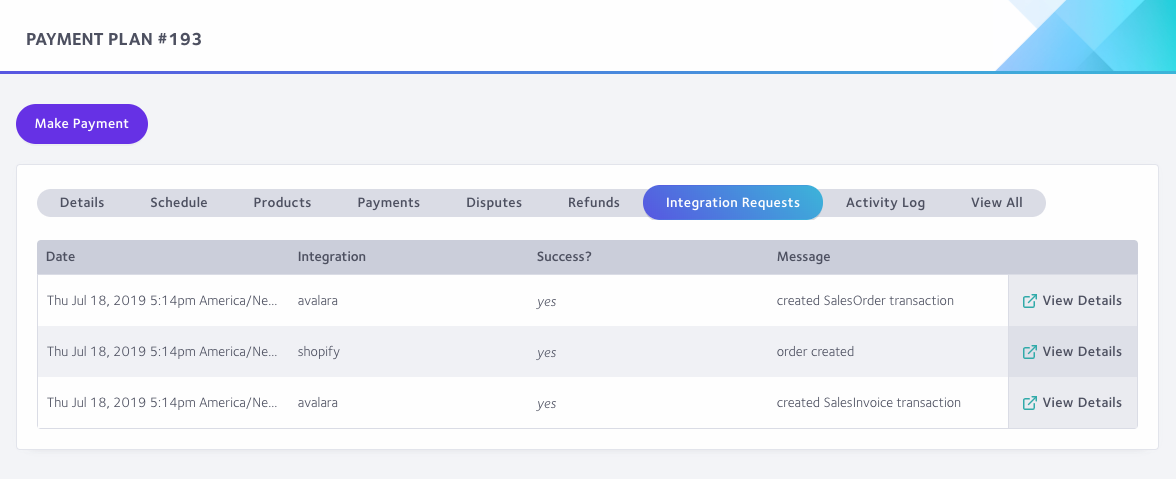

Request logging

When you check the Enable logging? checkbox on the AvaTax integration settings, Partial.ly will log all requests and responses from the AvaTax API. You can see the list of requests on a payment plan's details page, as seen below. If you have Enable document recording? checked, you will see the initial request to calculate the taxes, and a second request to commit the taxes when the plan is opened. Click the Integration Requests tab on a payment plan details page to see related requests.

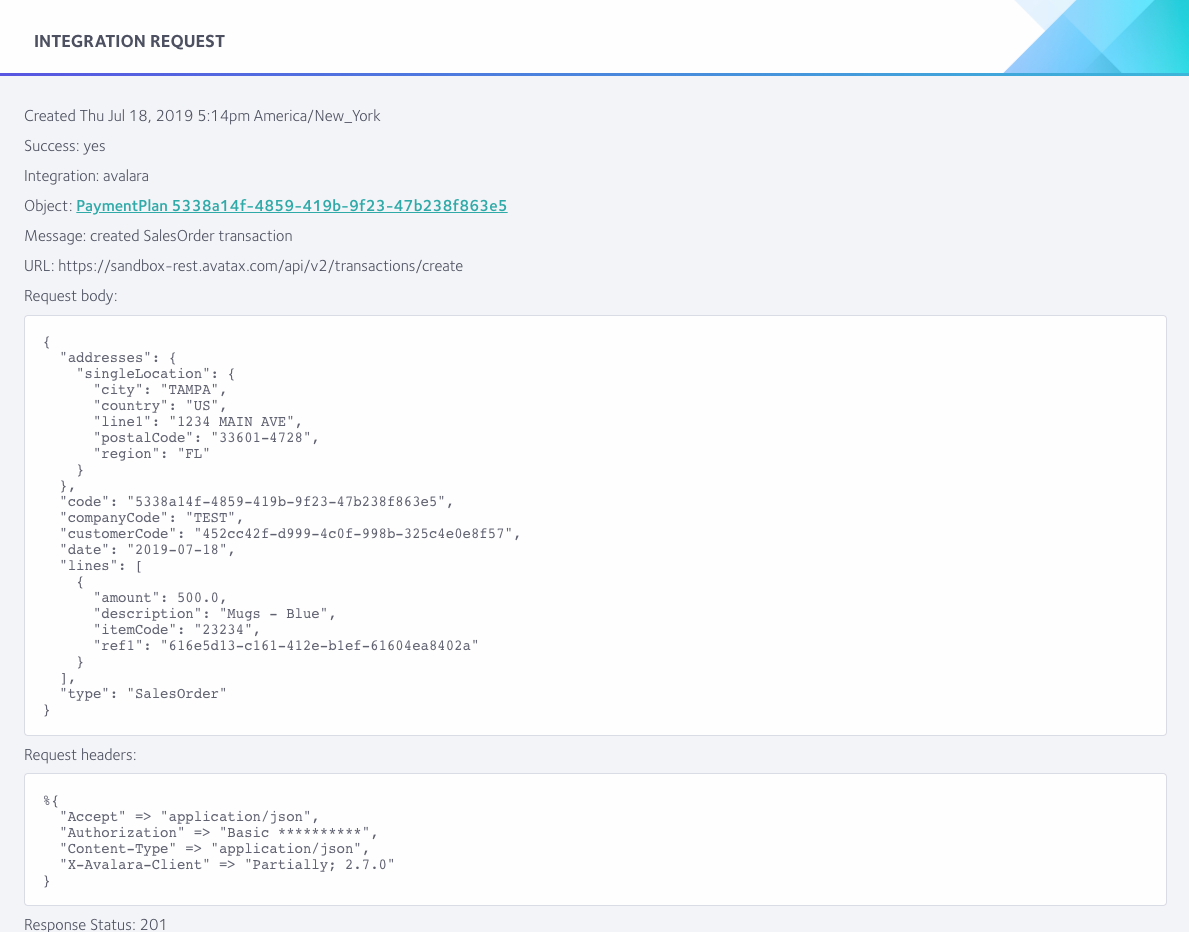

To see a request's details, click the details link. On the request details page, you can see all details of the request, such as: timestamp, URL, total execution time, request body, request header, response status code, response headers, and response body.

Ship from address

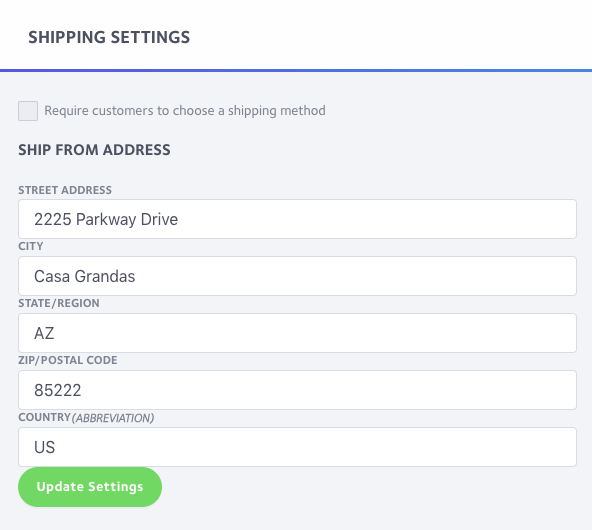

If you want to factor your shipping address into tax calculation, you can set the ship from address sent to AvaTax by going to your Shipping settings page.

Line item tax codes

If you need to configure tax codes per line item, you can can map product SKUs to tax codes in your Avalara AvaTax admin under SETTINGS > What you sell. Partial.ly will pass along the product SKU configured in your ecommerce platform (Shopify, BigCommerce, WooCommerce, etc) and pass that along to AvaTax to map to a tax code.